Introduction

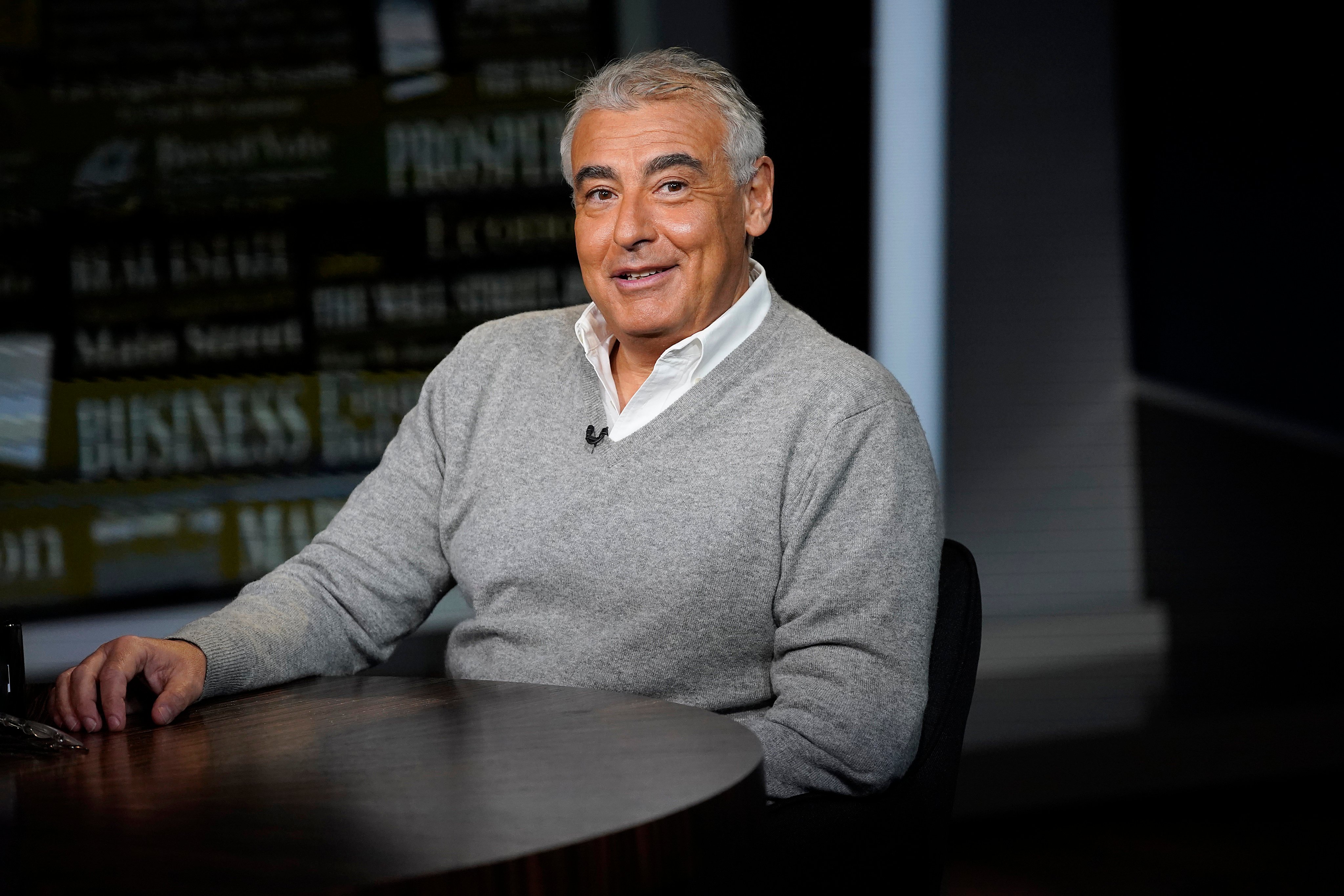

In the complex world of finance and investment, comprehending the delicate balance between threat and benefit is critical. At the leading edge of this philosophy is Marc Lasry, co-founder of Avenue Capital Group. With a career spanning over three decades in the hedge fund industry, Lasry has actually become associated with astute investment strategies and a keen understanding of market dynamics. This post digs deep into his approach concerning risk and benefit, exploring how it has actually formed Avenue Capital's success and offering insights for both experienced investors and beginners alike.

Evaluating Danger vs Reward: The Viewpoint of Marc Lasry at Avenue Capital

Marc Lasry's technique to investing encapsulates an essential truth: high returns frequently feature high risks. At Avenue Capital, this viewpoint is not simply a directing principle; it's embedded within the firm's DNA. But what does it actually indicate to assess threat versus benefit?

Lasry thinks that comprehending threat is not simply about measuring potential losses; it's also about recognizing chances where others see obstacles. By accepting a contrarian frame of mind, he has actually been able to determine underestimated possessions that present significant upside possible. For example, throughout economic slumps when lots of investors leave, Lasry has actually historically taken calculated threats to acquire distressed possessions at bargain costs.

The Importance of Due Diligence in Financial Investment Decisions

One key element in Lasry's method is rigorous due diligence. Before making any investment decision, he highlights detailed research and analysis. This involves:

- Understanding Market Trends: What are the current economic indications telling us? Analyzing Financial Statements: Is the business economically sound? Assessing Management Teams: Do they have a proven track record?

By carefully examining these aspects, Lasry makes sure that every investment aligns with his risk-reward framework.

Contrarian Investing: A Hallmark of Avenue Capital

A defining quality of Marc Lasry's philosophy is contrarian investing. However just what does this indicate? Put simply, it involves going against prevailing market trends or sentiments.

Identifying Opportunities in Adversity

Lasry Avenue Capital frequently states that "the best time to invest is when everybody else is fearful." During economic declines or periods of uncertainty, numerous investors tend to pull away. However, these minutes can provide distinct opportunities for those who attempt to be bold.

- Case Research study: Purchasing Distressed Assets

Throughout the monetary crisis in 2008, many saw catastrophe while others like Lasry saw opportunity. His strategic purchases throughout this time significantly reinforced Avenue Capital's portfolio performance when markets eventually recovered.

Balancing Act Between Fear and Opportunity

Investing needs a balanced mindset-- comprehending when to act decisively despite fear while likewise recognizing when caution is warranted.

The Function of Emotional Intelligence in Financial Investment Strategy

Marc Lasry highlights the value of emotional intelligence in navigating investments effectively. How do feelings play into investment choices?

- Fear vs Greed: Frequently investors are driven by emotions instead of logic. Crisis Management: Understanding how to handle one's own feelings throughout market volatility can result in better decision-making.

Lasry supporters for preserving composure during unstable times-- a quality that separates successful financiers from those who fail under pressure.

Leveraging Market Research for Informed Decisions

At Avenue Capital, comprehensive market research forms the foundation of financial investment methods. How does this research translate into actionable insights?

Macro-Economic Analysis- Understanding global economic trends Identifying sectors poised for growth

- Diving deep into specific industries Assessing competitive landscapes

- Gauging financier belief through numerous channels Utilizing social media information for real-time insights

Through these methods, Avenue Capital positions itself ahead of competitors by making informed decisions based on comprehensive analysis rather than mere speculation.

Strategic Asset Allotment at Avenue Capital

Asset allotment plays an important role in managing risk versus reward effectively. What are some essential considerations?

Diversification as a Threat Management Tool

Diversification isn't simply a market buzzword; it's an essential technique utilized by Lasry and his team at Opportunity Capital.

- By dispersing financial investments across different asset classes-- equities, set earnings, realty-- the firm alleviates threats related to any single asset class performing poorly. This approach guarantees that even if one sector suffers losses, other financial investments might still yield positive returns.

Dynamic Property Reallocation Practices

Market conditions fluctuate quickly; thus, static property allotment is seldom effective long-lasting.

- Regularly reviewing and adjusting portfolios allows Avenue Capital to respond proactively to changing market dynamics. This adaptability assists catch emerging chances while minimizing exposure to decreasing sectors.

The Influence of Historic Context on Financial Investment Strategies

Understanding historic context is essential for making informed predictions about future market movements.

Learning from Past Crises

Marc Lasry often reviews previous financial crises-- what lessons can be drawn from them?

Market Cycles Repeat Themselves

History tends to repeat itself; patterns observed throughout past recessions can notify existing strategies.

Behavioral Insights

Understanding how financier behavior shifts during crises provides important insight into future actions by market participants.

Long-Term Perspective

Effective investing needs perseverance; history shows that markets inevitably recuperate in time despite short-term volatility.

Navigating Regulatory Landscapes: Risks vs Rewards

In today's monetary landscape, regulatory structures shape financial investment strategies significantly.

Understanding Compliance Risks

Regulatory scrutiny can pose risks but also uses rewards if browsed effectively:

Maintaining compliance assists avoid legal pitfalls. Adapting quickly to regulative changes can offer competitive advantages. Being proactive about compliance fosters trust amongst financiers and stakeholders alike.FAQs About Marc Lasry and Avenue Capital

1. Who is Marc Lasry?

Marc Lasry is co-founder and CEO of Avenue Capital Group, renowned for his expertise in distressed securities investment.

2. What distinguishes Avenue Capital from other hedge funds?

Avenue Capital focuses on distressed possessions and uses a contrarian method towards investing-- contrary to common practices within hedge funds that follow mainstream trends.

3. How does Marc Lasry assess risk?

Lasry emphasizes comprehensive due diligence integrating quantitative analysis with qualitative evaluations-- consisting of psychological intelligence aspects connected to market behavior.

4. What function does diversification dip into Avenue Capital?

Diversification acts as a primary tool for mitigating risks connected with specific property classes while enhancing total portfolio durability versus market fluctuations.

5. How does emotional intelligence affect investment decisions?

Emotional intelligence aids investors like Lasry in maintaining composure during volatile durations; it encourages rational decision-making over emotionally-driven impulses which might cause losses.

6. Why is historical context important in investing?

Historical context supplies insights into potential future market habits based upon past cycles-- helping notify strategic decisions today while providing lessons gained from previous errors made by others in comparable situations.

Conclusion

In conclusion, "Examining Danger vs Reward: The Viewpoint of Marc Lasry at Avenue Capital" embodies more than simply an investment technique; it represents a holistic method towards understanding financial markets' intricacies through thorough evaluation integrated with psychological intelligence principles guiding decision-making get more info procedures in the middle of uncertainties inherent within them every action along their journey toward success!

By welcoming this philosophy wholeheartedly within their operational structure at Avenue capital group-- a well-rounded firm committed not only optimizing return potential but also promoting strength-- it ends up being evident why Marc lasry stays prominent figure among investors globally!

As we browse an unforeseeable economic environment defined by consistent modification-- the wisdom found within evaluating danger versus benefit is true now more than ever before!